These governing administration home loan plans for seniors are created especially for the lending requires of retirees. This can make it simpler for them to qualify for any loan.

A private loan calculator shows your month to month private loan payments determined by the loan total, fascination amount and repayment phrase. Furthermore, it displays the full fascination Charge, with or without having an origination price.

To make it easier, Obtain information about your income early and maintain two months of documentation for every.

Chris Jennings is a author and editor with more than seven several years of experience in the non-public finance and mortgage loan Area. He enjoys simplifying advanced mortgage loan matters for very first-time homebuyers and homeowners alike. His do the job is showcased inside of a n...

It doesn’t subject In case the cash flow has a defined expiration date. Lenders would require you to definitely document the normal and continued receipt of qualifying profits.

Quick Loan Direct highlights the necessity of an emergency fund and fast money answers for quick demands.

Comparable to a HELOC, household fairness loans use your house’s equity as collateral but functionality much more like a conventional loan with preset payments in excess of a set term.

Only certain varieties of money can be counted towards your qualifying profits for an asset depletion loan. These normally involve:

Facts presented on Forbes Advisor is for academic applications only. Your economic problem is unique plus the products and services we overview may not be suitable for the situations.

Pay Exclusive attention for the month-to-month payment, total desire expenses and interest charge or APR when evaluating particular loans.

Can a senior on Social Security get a home loan with a lower credit score? Getting a property loan which has a reduced credit history rating is hard but not unattainable. Some lenders focus on featuring mortgages to people with low credit score scores.

➜

Lenders glimpse beyond conventional documentation, like W-2s or spend stubs, and as an alternative take into account money flow from individual And maybe small business financial institution accounts.

An asset depletion loan can be a form of market loan, meaning it is designed to help a particular group of people enter into homeownership a lot quicker, as a result of distinct click here terms than regular loans.

Tatyana Ali Then & Now!

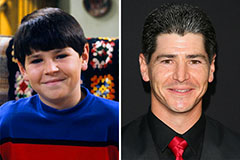

Tatyana Ali Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!